The bank you can build on

Embed banking directly into your products via our simple API. Grow your revenue and own your customer experience, while we do the heavy lifting on complex infrastructure.

We're here to help you build

- Safeguarding accountsPayments platforms

Develop smart payments solutions for any use case, powered by our dedicated safeguarding accounts.

- Client money accountsProptech and wealthtech

Empower your clients with dedicated CASS and CMP compliant accounts, with fast onboarding and easy reconciliation.

- Savings accountsFinancial wellness apps

Increase customer engagement and retention by offering white-label savings accounts with competitive interest rates.

- Griffin accountsLending

Simplify your flow of funds, with flexible operational accounts to enable easy loan collection.

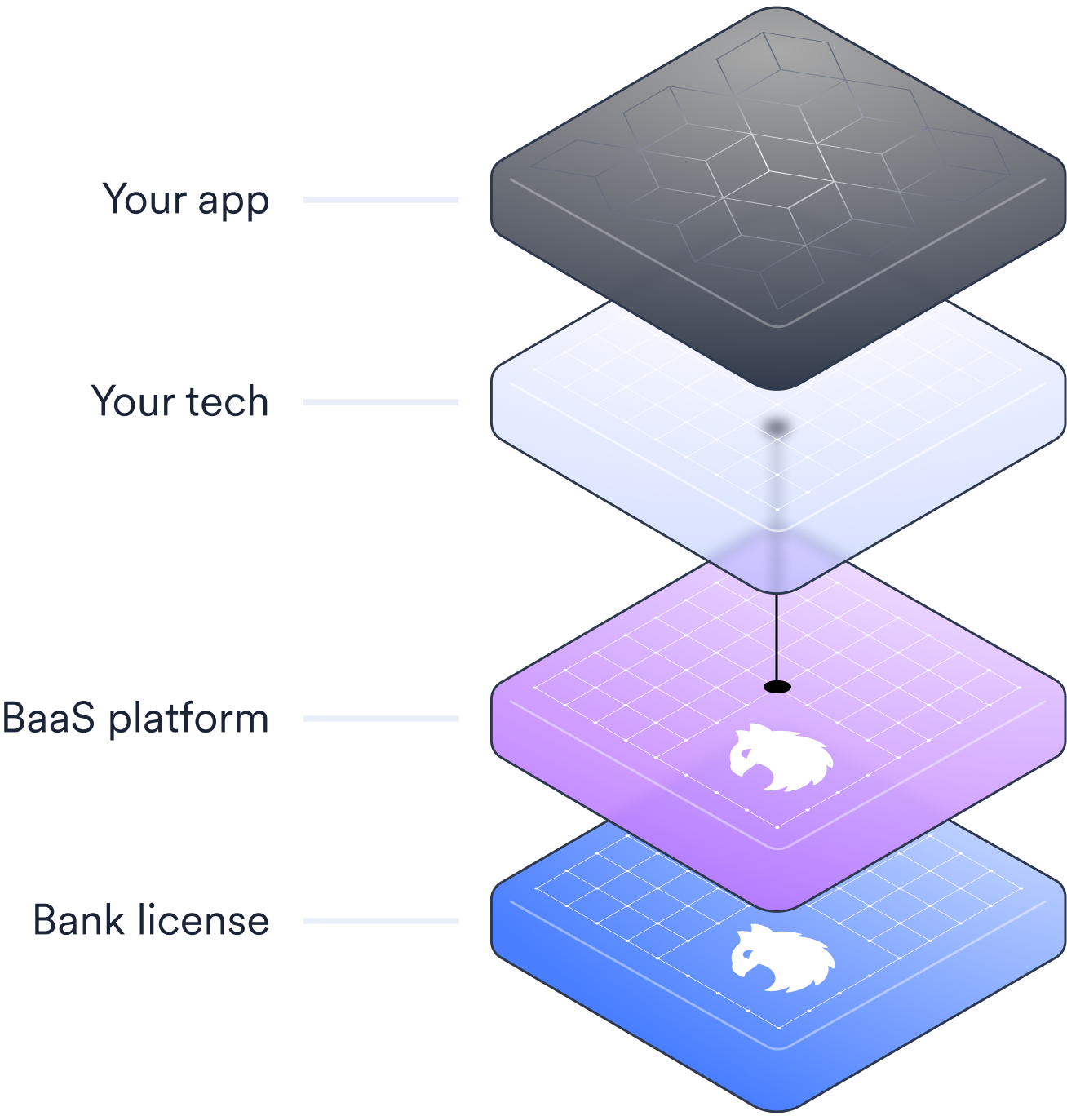

We put the bank in Banking as a Service

We combine the secure, regulated infrastructure of a bank with the speed and power of a purpose-built BaaS platform.

Our products

Safeguarding accounts

Ringfence your customers’ money in compliance with safeguarding regulations. Dedicated and pooled accounts available.

Client money accounts

Manage your clients' money in compliance with CMP, CASS, SRA or other industry regulation. Dedicated or pooled accounts available.

Embedded savings

Help your customers grow their money with interest-bearing savings account embedded seamlessly into your product or app.

Griffin accounts

Embed flexible API-driven accounts directly into your tech stack. Perfect for companies with complex money management needs.

Payments

Send UK domestic payments via FPS, and make instant transfers to other Griffin accounts. Bacs, CHAPS, and Direct Debit coming soon.

Verify

Automate KYC and financial crime prevention checks with our end-to-end customer onboarding product.

Let's start building

Build and scale your financial products on one powerful platform.